Mutual Fund (Plus) has a history of providing safe and diversifying returns to investors...

Friends, hope that until now, a lot of trial & error and money & time has been spent in social media forums to make them billionaires (owners of social media forum sites) without much personal benefit to you or you might have been lost, your money lured by online scammers (cheaters).

Let’s make some real income by using your Smartphone or Laptop/PC. It’s your turn now to make money through an internet facility. Of course, this will take some time as a business setup needs to take it off. Indeed, everything requires a little bit of patience and time, isn’t it?

In short, assets put money in your pocket and liabilities take money out of your pocket. Assets are the items you own that can make a profit for you. Liabilities are what you owe items, which take money from you.

Secure Your Financial Future…

Mutualfundplus.in with Assetplus’s platform where your dreams take flight! MutualFundPlus.in, in partnership with AssetPlus, stands out as India’s leading Mutual Fund Platform. This collaboration brings together MutualFundPlus.in’s user-friendly interface and AssetPlus’s cutting-edge technology, offering investors a seamless and efficient experience.

As a Mutual Funds Advisor, am here to guide you through the process of making informed investment decisions. Two popular investment strategies—Systematic Investment Plans (SIP) and lump sum investments—offer unique benefits tailored to different financial goals and risk appetites. Let’s explore why these options could be the key to achieving your financial aspirations.

Why Mutual Funds?

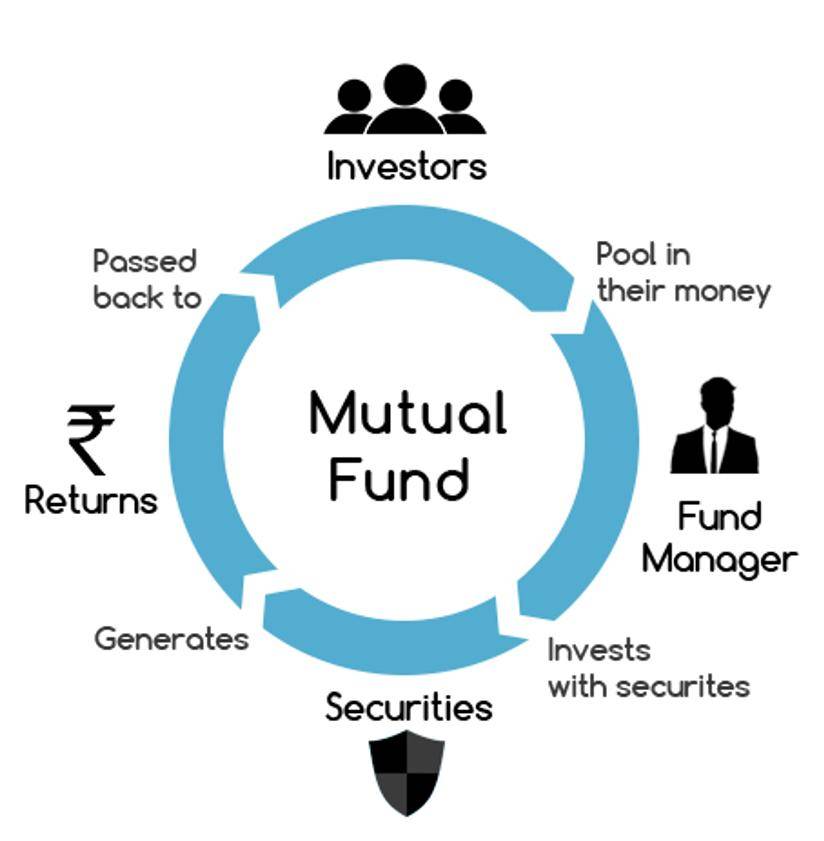

Mutual funds are a versatile and efficient way to grow your wealth over time. It collected money from various investors to invest in a diversified portfolio of stocks, bonds, and other securities, managed by experienced professionals. Here’s why mutual funds are the right choice for you:

- Diversification: By spreading your investments across various asset classes, mutual funds help reduce risk and improve potential returns.

- Professional Management: Our expert fund managers continuously analyze market trends and adjust portfolios to maximize gains and minimize risks.

- Flexibility: Whether you prefer a one-time lump sum investment or regular contributions through SIPs, mutual funds offer the flexibility to suit your financial situation.

- Accessibility: With low initial investment requirements, mutual funds are accessible to investors with varying budgets.

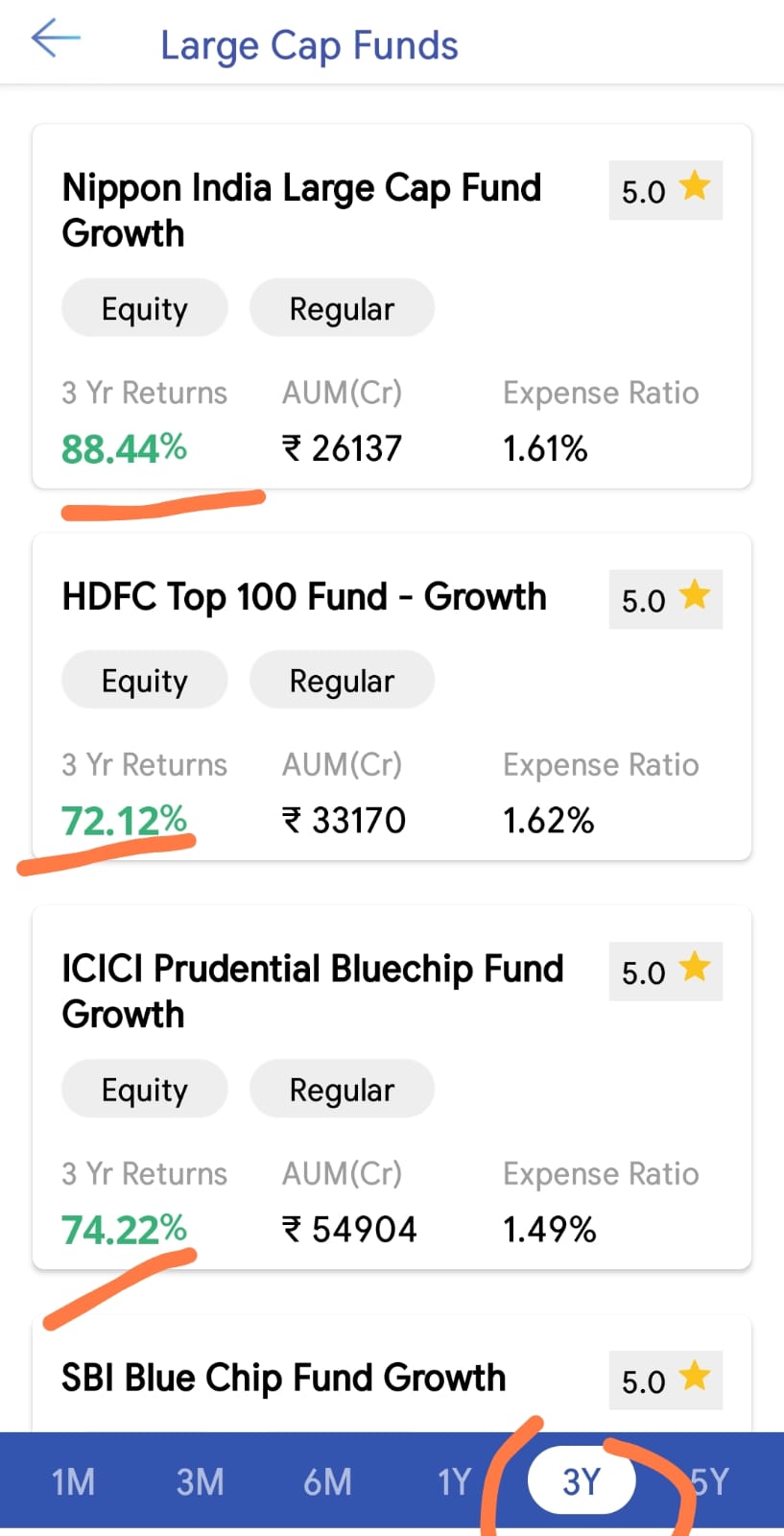

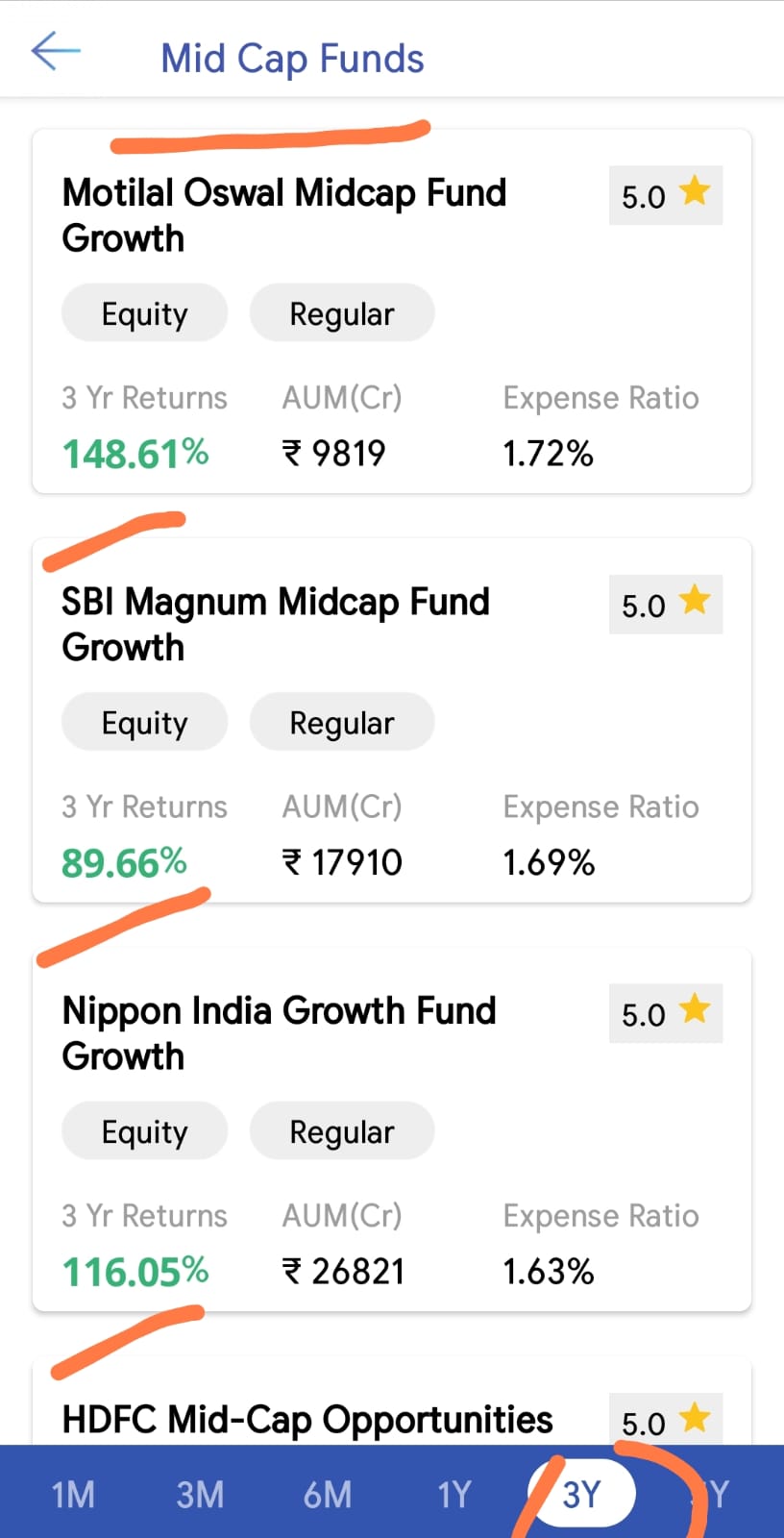

The historical returns of the mutual fund’s do not necessarily predict the future performance of the schemes. The mutual fund does not provide any guarantee or assurance. The quoted performance reflects past returns and does not guarantee future outcomes.

Invest in Your Child’s Education

Every parent Dreams of providing their Child with the Best Education possible. The rising cost of education can be sky rocketing, but with a strategic Mutual Fund investment, you can secure your Child’s future today. By investing either through a lump sum or a systematic investment plan (SIP), you’re setting a strong financial foundation for their higher education. Let us help you turn your child’s dreams into reality, ensuring they have the resources to attend top institutions and achieve their full potential. Start early to give your child the best opportunities. With education costs rising rapidly, a well-planned investment in mutual funds can ensure you’re financially prepared when the time comes.

Plan for a Beautiful Wedding

Weddings are joyous occasions that can also come with significant expenses. Plan ahead with mutual funds to ensure you’re financially ready for all the celebrations and ceremonies. Our SIP options allow you to save consistently over time, reducing the financial burden and making your special day unforgettable. Whether you’re planning for your own wedding or saving for your Child’s special day, Mutual Fund’s SIP can help you amass the funds needed to create a magical celebration. Regular SIPs ensure you accumulate wealth steadily, while lump sum investments can give a significant boost if you have a longer time horizon. Make the Dream wedding a reality without financial stress, allowing you to focus on the joyous occasion.

Create Unforgettable Holiday Experiences

Life is about experiences, and nothing enriches it more than travel. Whether it’s a yearly getaway or a once-in-a-lifetime adventure, our mutual funds can help you accumulate the necessary funds. Start small with monthly SIPs and watch your holiday fund grow, bringing you closer to your dream destinations. Everyone deserves a break from the routine, and what better way to do so than by exploring new destinations and creating lasting memories with loved ones? Whether it’s a serene beach vacation, a thrilling adventure trip, or a cultural exploration, investing in Mutual Fund’s SIP can help you save up for that perfect Holiday. Start today with our SIP options, and watch your savings grow, bringing you closer to your dream holiday.

Build Wealth for the Future

Building substantial wealth requires strategic planning and disciplined investing. Our wealth creation funds are designed to optimize returns over the long term, taking advantage of market opportunities while managing risks. Whether through lump sum investments or regular SIPs, you can build a strong financial foundation for future endeavors. Be it buying a new home, starting a business, or simply building a nest egg for the future, Mutual Funds offer a versatile investment avenue. With our expert fund managers, your investments are diversified across various asset classes. Start with a lump sum if you have a substantial amount to invest or opt for monthly SIPs to build your wealth gradually. The power of compounding will work in your favour, helping you achieve your Financial Goals faster.

Ensure a Comfortable Retirement

Retirement should be a time of peace and enjoyment, not financial worry. Our retirement-focused mutual funds offer a balanced approach, providing the growth potential of equities and the stability of bonds. Start planning early with SIPs or boost your savings with lump sum investments, ensuring a comfortable and worry-free retirement. Retirement is the time to reap the rewards of your hard work and Enjoy Life to the fullest. To ensure you have a comfortable and financially Secure Retirement, investing in mutual funds is a smart choice. Start early with SIPs or boost your Retirement corpus with a lump sum investment. Let us help you build a substantial Retirement Fund, giving you peace of mind and the freedom to pursue your passions.

Personalized Guidance and Support

At mutualfundplus.in with partners.assetplus’s platform, we understand that every investor has unique goals and aspirations. Our dedicated team of financial experts is here to guide you every step of the way, providing personalized advice and robust investment solutions. With our user-friendly online platform, you can easily track your investments, make informed decisions, and stay updated on market trends.

Easy and Convenient Investing

We believe in making investing as simple and accessible as possible. Our online platform allows you to: Easily track your investments: Stay updated with real-time data and comprehensive reports.

- Make informed decisions: Access expert analysis and market insights.

- Seamlessly manage your portfolio: Adjust your investments with just a few clicks.

Join thousands of satisfied investors who have trusted us to help them achieve their Financial Dreams. Start investing today, and take the first step towards a secure and prosperous future. Your dreams are our mission, and together, we can make them a reality.